A variable-rate mortgage is a mortgage with an interest rate that adjusts in time based upon the market. ARMs commonly begin with a reduced interest rate than fixed-rate home mortgages, so an ARM is a fantastic alternative if your goal is to obtain the most affordable feasible price. Variable rate home loans are one of the most common type of lending for home acquisition in the UK, Ireland as well as Canada however are unpopular in some other nations such as Germany. Variable price home mortgages are very common in Australia and also New Zealand. These are the limits on just how much the https://www.puretravel.com/blog/2017/10/17/feel-more-at-home-in-your-timeshare-this-season/ rates of interest or the regular monthly payment can be altered at the end of each adjustment period or over the life of the financing.

Naturally, there is constantly the risk that you won't have the ability to market your home before your rate adjusts. If that occurs, you might wish to think about refinancing into a fixed-rate or a brand-new adjustable price home loan. Nevertheless, you're still running the risk that rate of interest will have enhanced at that point. See the complete write-up for the type of ARM that Unfavorable amortization car loans are by nature. Higher risk products, such as First Lien Month-to-month Adjustable finances with Unfavorable amortization and also House equity lines of credit have various methods of structuring the Cap than a typical First Lien Home mortgage.

- They normally offer customers five to 10 years prior to prices change for the very first time.

- For example, a 2/2/5 cap framework might sometimes be created merely 2/5.

- They then failed en masse when their originally reduced home loan repayments instantly expanded as well expensive.

- You may still get approved for a lending also in your scenario does not match our assumptions.

A former government home mortgage financial auditor estimated these errors produced at the very least US$ 10 billion in net overcharges to American home-owners. Such mistakes occurred when the related mortgage servicer chose the inaccurate index donate timeshare to charity date, made use of an inaccurate margin, or ignored rate of interest change caps. As an example, if the debtor makes a minimum settlement of $1,000 and also the ARM has accumulated regular monthly interest of $1,500, $500 will certainly be added to the borrower's financing balance. Moreover, the next month's interest-only payment will be determined making use of the brand-new, greater principal equilibrium. When just two values are given, this shows that the preliminary adjustment cap and also routine cap coincide. As an example, a 2/2/5 cap structure might sometimes be written merely 2/5.

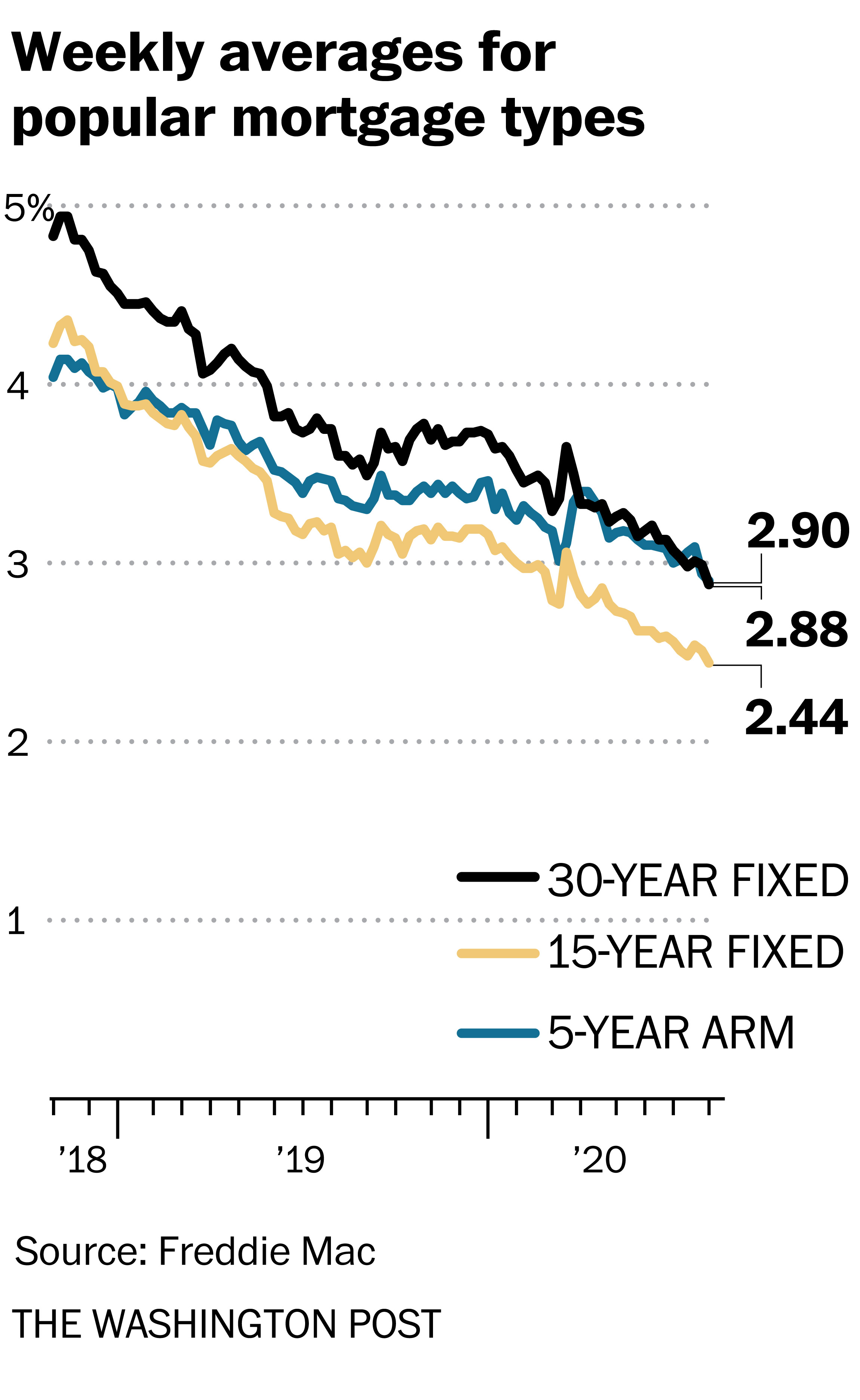

Today's Prices

The degree of prices of timeshares earnings you have will help the loan provider determine how large of a home mortgage settlement you can receive. As an example, allow's state that you take out a 30-year ARM with a 5-year set duration. That would certainly bring about a set price for the very first 5 years of the funding. Afterwards, your rate could increase or down for the remaining 25 years of the lending.

Repaired

For example, a mortgage rates of interest might be defined in the note as being LIBOR plus 2%, 2% being the margin as well as LIBOR being the index. Kan added that in the past one decade, "we have seen a shift toward ARM financings with longer fixed-rate periods, i.e. a shift far from 3/1 and 5/1 ARMs to a bulk 7/1 and also 10/1 ARMs, based on our applications data." Another essential factor to consider is that ARMs now comprise a single-digit percent of all home loans, whereas throughout the bubble years they had to do with 35% of the overall.

Once the ARM price modifications, the debtor's rate and also repayment usually go higher or lower relying on the state of the economic climate. For instance, a consumer with a 7/1 ARM would have a fixed rate-- or lower settlement-- for the initial seven years before the price switches. With home loan rates rising-- as well as prices anticipated to continue to boost-- real estate representatives see more and more house customers checking into as well as utilizing the ARM funding alternative instead of the typical 30-year set price. Reset day is a moment when the preliminary fixed interest rate on a flexible rate home mortgage changes to a flexible rate. With variable-rate mortgage caps, there are limits set on just how much the rate of interest and/or payments can climb each year or over the lifetime of the lending. When prices rise, ARM customers can expect to pay higher month-to-month home loan payments.

Payment-option ARMs have a built-in recalculation duration, usually every five years. There are a great deal of details to keep track of in picking this type of car loan, so buyer beware. Charles Schwab Bank, SSB and Charles Schwab & Co., Inc. are separate yet associated firms as well as subsidiaries of The Charles Schwab Corporation.

This can create challenge on the debtor's component if they can't manage to make the new payment. ARMs have a fixed time period during which the first rate of interest stays continuous, after which the rates of interest adjusts at a pre-arranged frequency. The fixed-rate duration can vary substantially-- anywhere from one month to ten years; shorter modification periods usually carry lower initial rates of interest. After the preliminary term, the car loan resets, meaning there is a new rates of interest based on existing market prices.

A lot of ARMs offer a 5% lifetime modification cap, but there are higher life time caps that could eventually cost you a lot more. If you're thinking about an ARM, ensure you completely comprehend exactly how rate cap quotes are formatted and just how high your regular monthly settlements can obtain if interest rates climb up. Choice ARMs are frequently provided with an extremely reduced teaser price (frequently as low as 1%) which equates into very reduced minimum settlements for the initial year of the ARM.

For many individuals, the first fixed-rate period matches for how long they'll remain in their house before they move or re-finance. Germain Vault Institutions Act of 1982 allowed Flexible rate mortgages. Alternative ARMs are best fit to sophisticated consumers with expanding incomes, especially if their earnings change seasonally and they need the settlement adaptability that such an ARM may offer. Innovative consumers will very carefully handle the level of unfavorable amortization that they enable to accrue. The arrangement with the loan provider might have a stipulation that enables the buyer to convert the ARM to a fixed-rate home mortgage at assigned times.